utah county sales tax calculator

The Utah County sales tax rate is. The following documents give cross-listings of Utahs cities towns counties and entity codes for sales and use tax purposes.

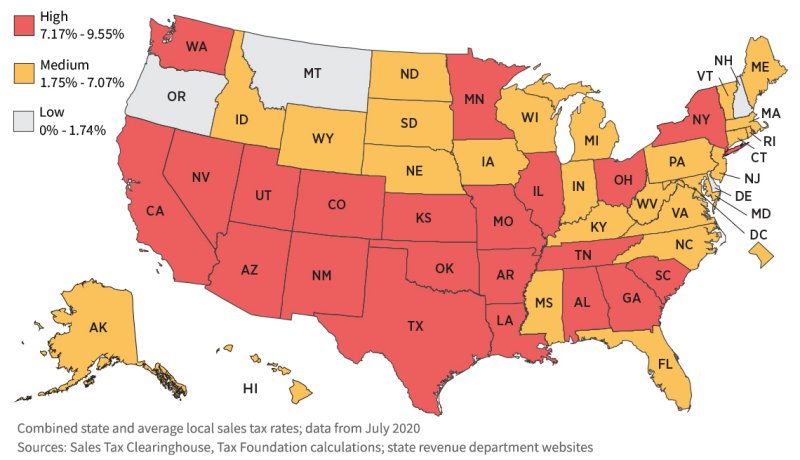

State And Local Sales Taxes In 2012 Tax Foundation

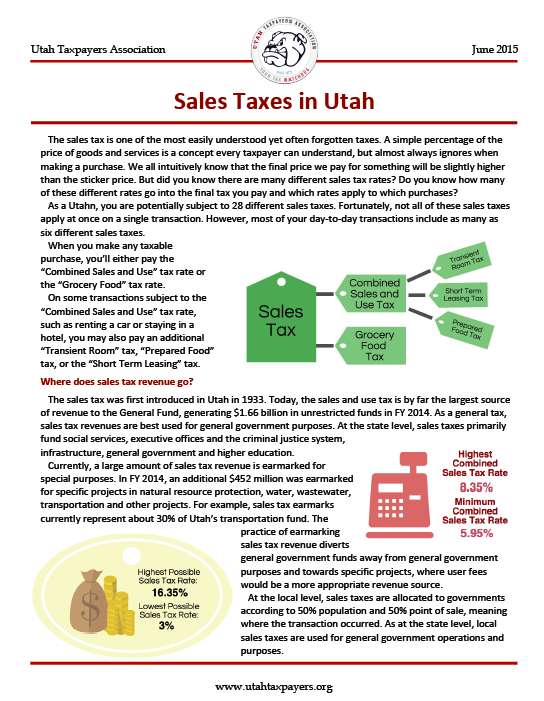

If you purchase any product or service in Utah youre subjected to the states general sales tax rate listed at 485 percent.

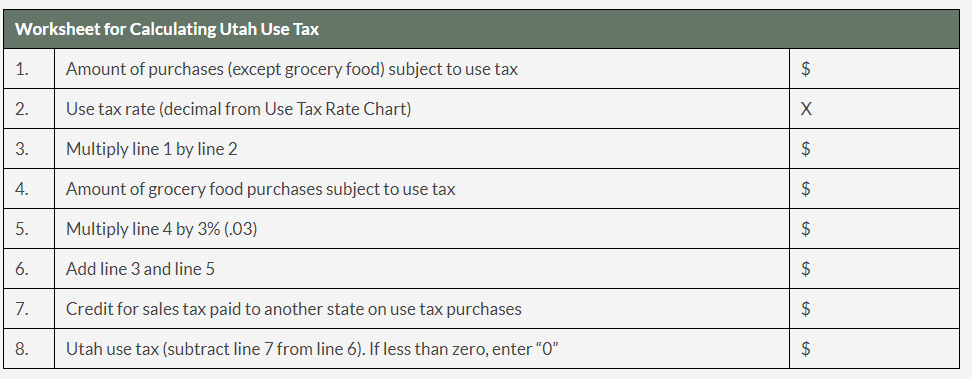

. Streamlined Sales Tax SST Training Instruction. Overall taxpayers in Utah face a relatively low state and local tax burden. Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers.

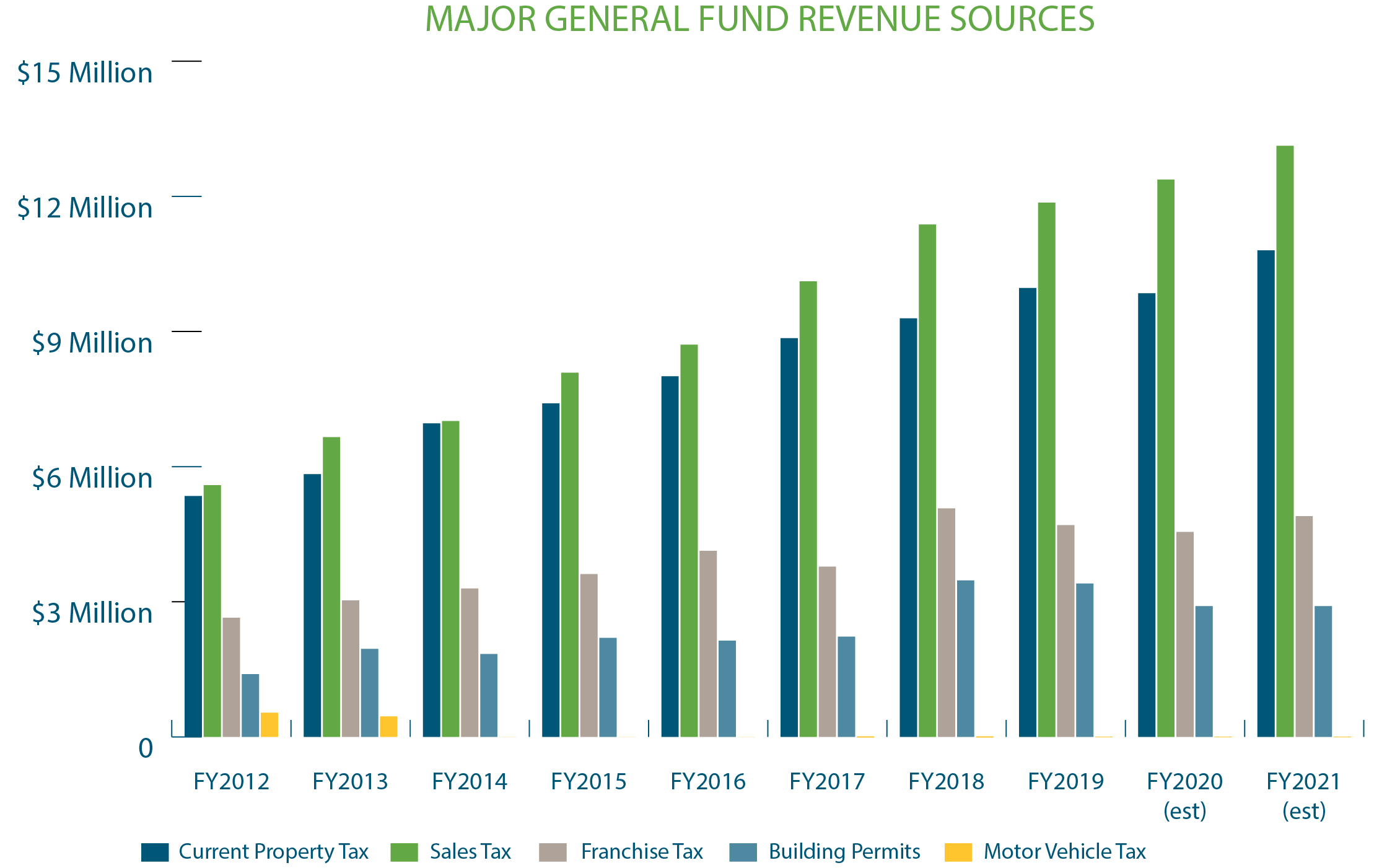

Total rates in Utah county which apply to assessed value range from 0907 to 1451. S Utah State Sales Tax Rate 595 c County Sales Tax Rate l Local Sales Tax Rate sr Special Sales Tax Rate You can calculate Sales Tax manually using the formula or use the Utah County Sales Tax Calculator or compare Sales Tax between different locations within Utah using the Utah State Sales Tax Comparison Calculator. UTAH CODE TITLE 59 CHAPTER 12 - SALES USE TAX ACT COMBINED SALES AND USE TAX RATES Tax Rates Subject to Streamline Sales Tax Rules OTHER TAXES APPLY TO CERTAIN TRANSACTIONS Rates In effect as of October 1 2021 Please see instructions below Cnty City Hosp Arts Zoo Combined Location Code ST LS CO MT MA MF CT HT HH AT CP SM RH CZ.

With local taxes the total sales tax rate is between 6100 and 9050. The Utah County Utah Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Utah County Utah in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Utah County Utah. Daniel k inouye international airport hub for.

The current total local sales tax rate in Utah County UT is 7150. Cities and municipalities in Utah can collect sales taxes up to the. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov.

The 2018 United States Supreme Court decision in South Dakota v. The base state sales tax rate in Utah is 485. Select the Utah county from the list below to see its current sales tax rate.

The Utah state sales tax rate is currently 485. Download all Utah sales tax rates by zip code The Taylorsville Utah sales tax is 685 consisting of 470 Utah state sales tax and 215 Taylorsville local sales taxesThe local sales tax consists of a 135 county sales tax and a 080 special district sales tax used to fund transportation districts local attractions etc. Sales Tax Calculator Sales Tax Table Utah UT Sales Tax Rates by City all The state sales tax rate in Utahis 4850.

Utah has recent rate changesThu Jul 01 2021. Beograd na vodi najnovije. That is the sixth-highest figure among Utah counties but is still more than 1000 less than the national median.

File electronically using Taxpayer Access Point at taputahgov. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. The minimum combined 2022 sales tax rate for Washington County Utah is 645.

All Utah citiestowns listed alphabetically by county. Osa biophotonics congress 2021. Alphabetical listing of all Utah citiestowns with corresponding county.

Find your Utah combined state and local tax rate. This is the total of state and county sales tax rates. The median annual property tax paid by homeowners in Utah County is 1517.

To find out the amount of all taxes and fees for your particular vehicle please call the DMV at 801 297-7780 or 1-800-DMV-UTAH 800-368-8824. Utah sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. The minimum combined 2022 sales tax rate for Utah County Utah is.

The Utah state sales tax rate is currently. This is the total of state and county sales tax rates. The December 2020 total local sales tax rate was also 7150.

Homeowners in Utah also pay exceptionally low property taxes with an average effective rate of just 058. Calculate By ZIP Codeor manually enter sales tax Utah QuickFacts. Local tax rates in Utah range from 0 to 4 making the sales tax range in Utah 47 to 87.

Some cities and local governments in Utah County collect additional local sales taxes which can be as high as 16. Utah has 340 cities counties and special districts that collect a local sales tax in addition to the Utah state sales taxClick any locality for a full breakdown of local property taxes or visit our Utah sales tax calculator to lookup local rates by zip code. The various taxes and fees assessed by the DMV include but are.

Utah sales tax calculator. The Washington County sales tax rate is 16. Utah has a 485 statewide sales tax rate but also has 208 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2053 on top of the state tax.

The Utah County Sales Tax is 08 A county-wide sales tax rate of 08 is applicable to localities in Utah County in addition to the 485 Utah sales tax. Download all Utah sales tax rates by zip code The Utah County Utah sales tax is 675 consisting of 470 Utah state sales tax and 205 Utah County local sales taxesThe local sales tax consists of a 180 county sales tax and a 025 special district sales tax used to fund transportation districts local attractions etc. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors.

The 2018 United States Supreme Court decision in South Dakota v. Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800. Week 2 nfl fantasy football.

Utah sales tax calculator. In Provo the total rate is 1136. Its largest city is Provo.

If you need access to a database of all Utah local sales tax rates visit the sales tax data page. Sales taxes in Utah range from 610 to 905 depending on local rates. 89 rows The Combined Sales and Use Tax Rates chart shows taxes due on all transactions.

Car Tax By State Usa Manual Car Sales Tax Calculator

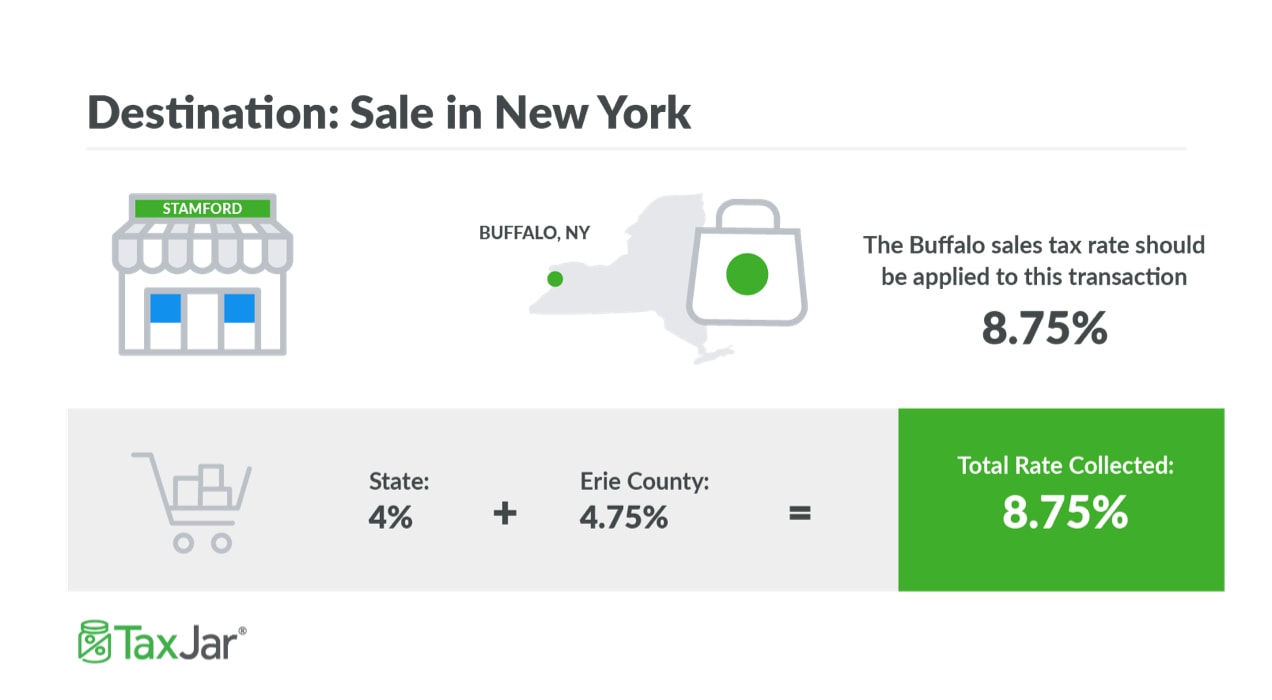

How To Charge Your Customers The Correct Sales Tax Rates

Car Tax By State Usa Manual Car Sales Tax Calculator

What Is Utah S Sales Tax Discover The Utah Sales Tax Rate For 29 Counties

Utah Sales Tax Information Sales Tax Rates And Deadlines

States With Highest And Lowest Sales Tax Rates

Utah Sales Tax On Cars Everything You Need To Know

The Utah Income Tax Rate Is 4 95 Learn How Much You Will Pay On Your Earnings

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Utah Sales Tax Small Business Guide Truic

Free Utah Payroll Calculator 2022 Ut Tax Rates Onpay